How does Uniswap determine whether implementing a protocol fee would benefit its protocol in the long term? How do ecosystems like NEAR upgrade their staking and governance structures to better align stakeholder incentives with evolving priorities? How do new deployments like Unichain build a multi-million dollar growth campaign that leads to sustainable growth?

They hire Gauntlet Applied Research.

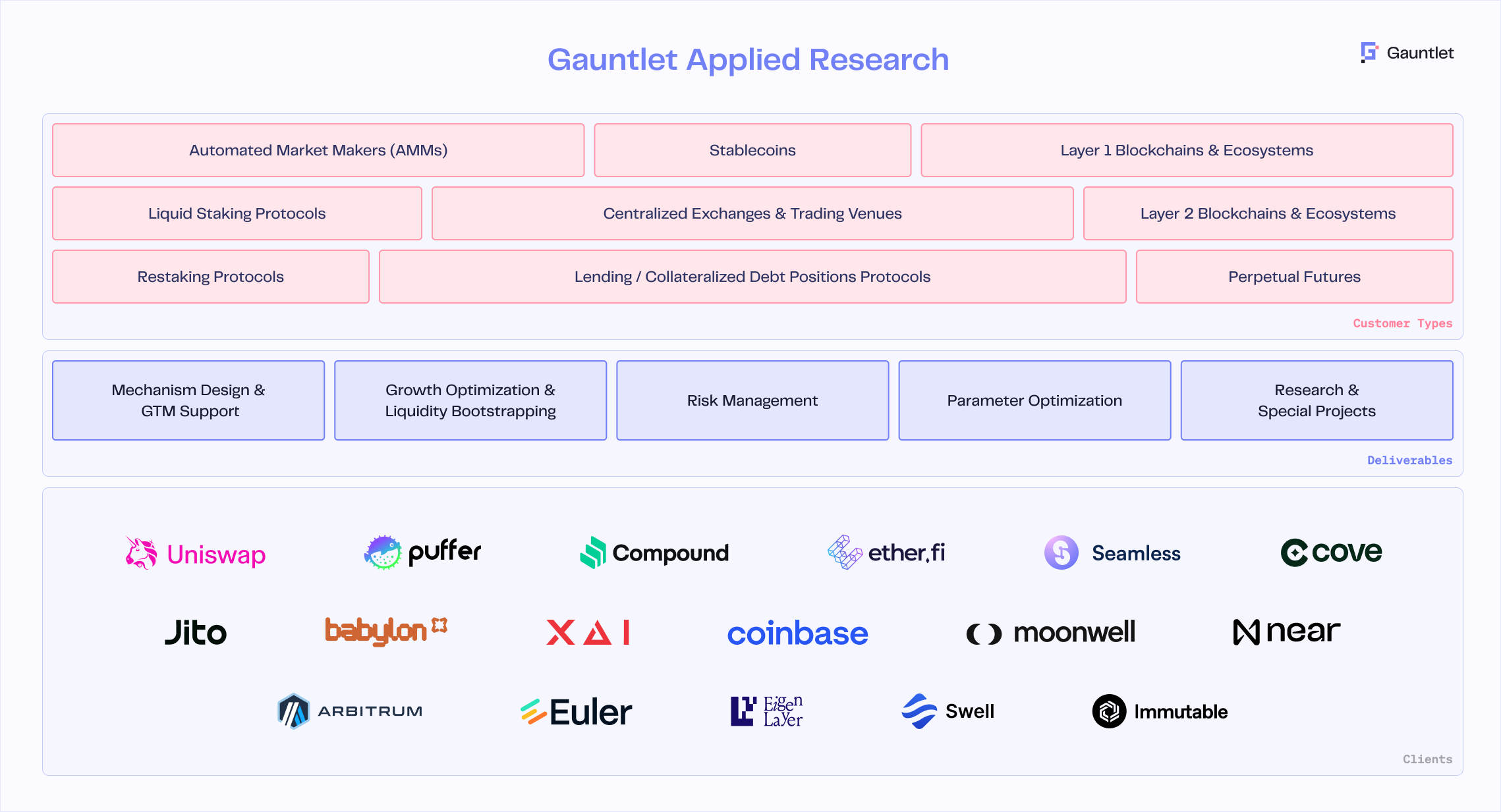

Gauntlet Applied Research (GAR) transforms cutting-edge quantitative modeling and data science into concrete solutions that drive measurable results. We deliver customized optimization programs, risk mitigation frameworks, and sustainable growth strategies tailored to our clients’ goals.

We empower projects across their lifecycle with advanced quantitative analysis, agent-based simulation modeling, and robust economic design principles to launch and scale successfully. Our team combines cryptoeconomic research expertise with institutional-grade financial modeling, having supported dozens of protocols with over $42B in overall TVL.

GAR clients include protocols of all sizes including sectors such as lending, automated market making, spot and perpetuals trading, and staking/restaking. From industry leaders like Coinbase to dynamic startups like Seamless and Moonwell, GAR brings added flexibility to Gauntlet's suite of services.

Our GAR team is comprised of research and data scientists with expertise in four primary areas:

- Mechanism Design and Go-to-Market Support with mechanism development and economic audits. GAR develops and reviews smart contract designs focusing on tokenomics, staking, and governance, providing go-to-market support and post-launch monitoring.

- Growth Optimization and Liquidity Bootstrapping via strategy design and optimization. GAR develops and manages liquidity and app activity growth campaigns for early-stage and established protocols to unlock stable liquidity formation and robust market depth.

- Risk Management that includes custom framework development and economic security analysis. GAR identifies and mitigates protocol and app vulnerabilities to help protocols adapt to shifting market conditions and safeguard users.

- Parameter Optimization that leverages our stress-tested analytics platform used by major DeFi protocols for seven years. GAR pinpoints safe and capital-efficient parameters for a variety of protocols and delivers ongoing monitoring, assessments, and systematic or manual parameter updates.

In the coming weeks, we’ll dive into each of our core offerings and provide case studies that illustrate the impact of our work. In the meantime, we invite you to explore our website to learn more about our Applied Research team.

Gabe Pohl-Zaretsky

Blog

View the full presentation

Read the full paper

.png)