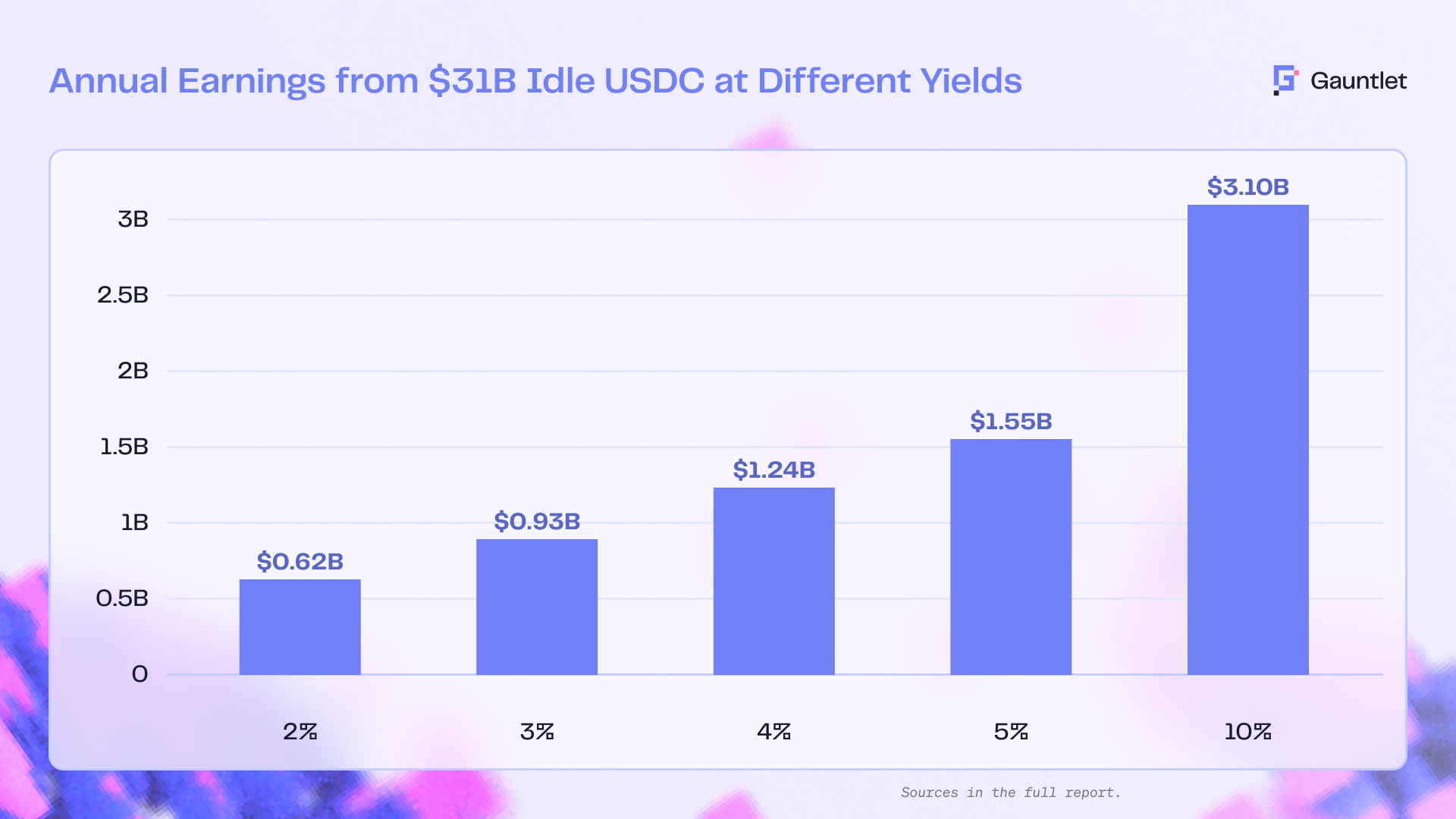

Yield is core to nearly every stablecoin onchain use case. However, up to $46B in USDC sits on the sidelines, forgoing over $1B in yield per year.

Today, we released Thaw Potential: How DeFi Can Unlock Value For $46 Billion in USDC, an in-depth report analyzing onchain USDC flows. In this report, we map where USDC is idle by chain, break down how the non-idle portion is actually used, quantify the opportunity cost, and outline why our USDC yield vaults are designed to close this gap.

Download the full report here.

Note: The snapshot data was pulled in mid-August 2025. Since then, USDC has added over $15 billion in TVL, and stablecoins have grown by over $30 billion. Throughout the report, we highlight Circle Collaboration Agreements, which are sometimes considered idle and elsewhere considered deployed, depending on the chain and circumstances.

Cold Frontier: State of Play

%20ETHEREUM%2C%20ARBITRUM%2C%20BASE%2C%20SOLANA.png)

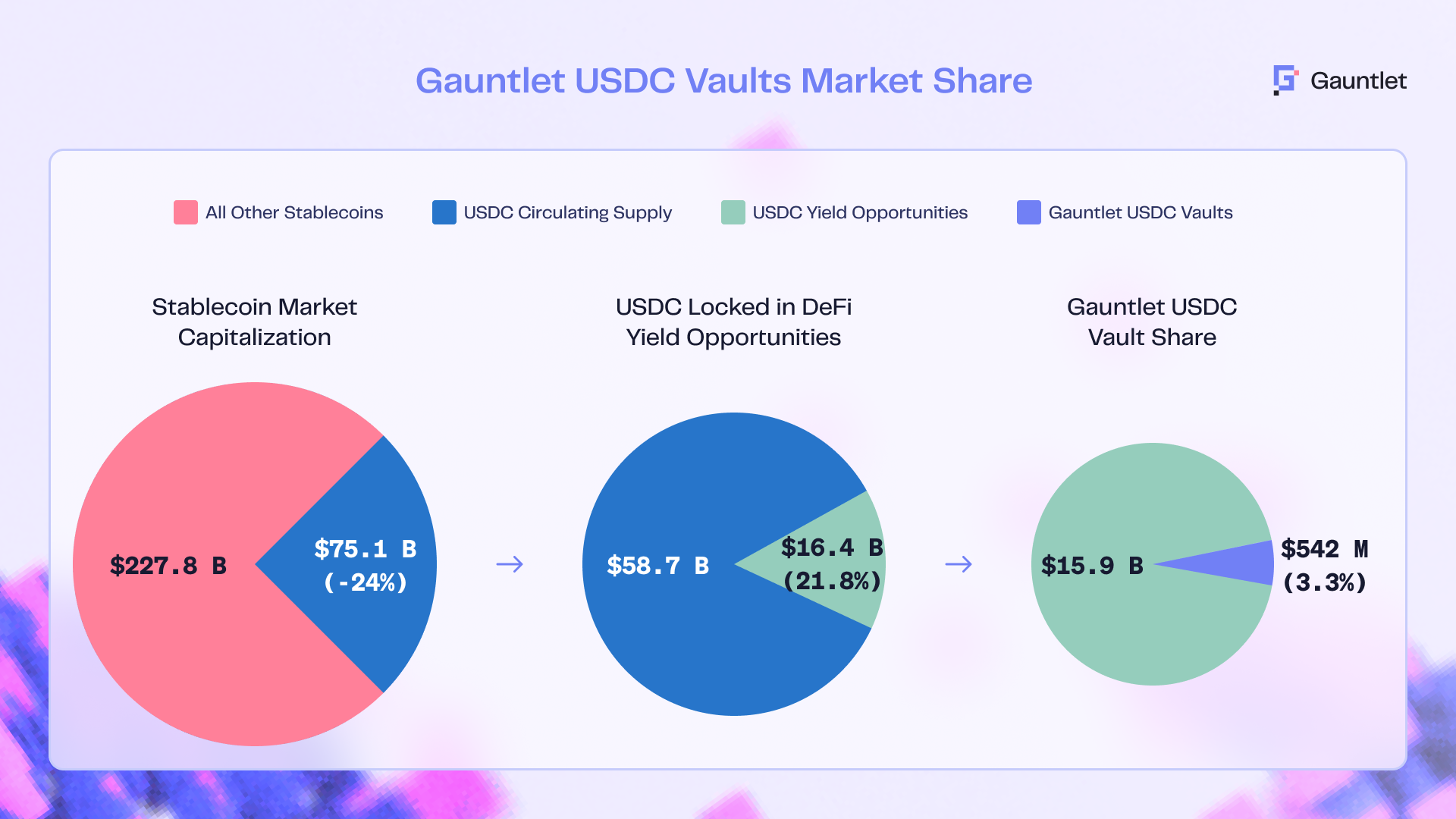

Circle’s USDC is one of DeFi’s most liquid assets, with a circulating supply of over $75 billion. More than half of the USDC supply, $45.5 billion, lives on Ethereum, with over $10 billion on Ethereum Layer-2s and roughly $10.8 billion on Solana.

Stablecoin competition is heating up. There are over 300 stablecoins in circulation, and ten have a market cap over $1 billion. Established players like Circle’s USDC and new entrants alike are rapidly innovating to drive user adoption and retention. Yield is a primary lever in that battle.

Along with regulatory clarity from the GENIUS Act passed earlier this year, other stablecoin tailwinds include banks and fintechs planning to launch their own stablecoins on Layer 1s and 2s and growing smart wallet adoption for consumer applications and wallets.

Layers of Ice: Ethereum vs. L2s and Solana

Across Ethereum, Arbitrum, Base (the top 3 EVM blockchains by circulating USDC), and Solana, USDC deployed in DeFi totals only $6.78 billion (10% of the total USDC on those blockchains). That implies roughly $46 billion USDC (over 70% of supply) could be more productive.

Defrosting: How USDC Generates Yield in DeFi

Why is this capital idle? While more conservative holders may recall past crashes (e.g. Anchor’s collapse and the 2022 bear market) and shy away from double-digit APYs, the stablecoin yield landscape has matured. DeFi offers sustainable, transparent yield opportunities. Risk curators have come on the scene and play a crucial role in upside growth and downside capital preservation. In the report, we categorize USDC activity into the following segments:

- Circle Collaboration Agreements that drive yield for users when held on centralized exchanges.

- Vaults and lending markets on protocols like Morpho, Compound, Aave, and Euler facilitate the onchain lending of USDC to borrowers.

- Automated market maker (AMM) liquidity provision that generates swap fees plus rewards in protocol tokens.

- Structured and tranching vaults that deploy USDC in delta-neutral strategies or tranche-based overlays, such as our perpetual futures vaults on Drift.

- Real-World Asset (RWA) lending platforms such as Maple Finance that underwrite and lend USDC to institutional borrowers.

Gauntlet Vaults: a New Way to Generate Sustainable Yields in DeFi

Our vaults equip capital allocators with data-driven strategies to confidently allocate USDC onchain. With 75+ vaults across chains, protocols, and strategies, our curation work drives yield for USDC holders.

We curate vaults across Ethereum, Solana, and multiple L2s, where users can supply USDC based on risk preferences. Holders don’t have to choose between sitting idle and spending hours yield hunting; these vaults are designed to optimize risk-adjusted returns using the same simulation models we deploy for leading DeFi protocols.

In DeFi, cash doesn’t have to earn TradFi rates. The data shows that a vast amount of USDC is idle on Ethereum, Arbitrum, Base, Solana, and likely across other chains. For sophisticated DeFi users and institutions, this represents an enormous untapped resource. Redirecting even a portion of those sidelined billions into yield-generating vaults can unlock an entirely new universe of yield.

Blog

View the full presentation

Read the full paper